Emotion in Economics: Reimagining Decision-Making Through the Core Emotion Framework

Step beyond the ledger lines and rational myths—

into the territory where heartbeat meets headline,

where decisions swirl not from spreadsheets,

but from the gut’s intuition and the mind’s mirage.

Come trace the emotional architecture beneath economic tides,

where the Core Emotion Framework (CEF) offers

a map of motion beneath money—

ten pulses, three centers, one embodied clarity.

This is not your economist's economy.

It’s a framework that feels, forecasts, and fumbles—

as all humans do.

Come feel it, rethink it, reframe it.

The Core Emotion Framework: A Novel Approach to Resolving Economic Questions and Understanding

Traditional economic models, predicated on the assumption of rational agents, frequently fall short in explaining real-world economic phenomena. The emergence of behavioral economics and neuroeconomics has highlighted the profound and often irrational influence of emotions and cognitive biases on decision-making.

This article introduces the Core Emotion Framework (CEF) as a unique, granular model for understanding and leveraging fundamental emotional processes. It explores how CEF's tripartite structure (Head, Heart, and Gut) and its ten core emotional processes can provide a novel lens for analyzing and potentially influencing economic behaviors. By integrating CEF with established academic research in behavioral economics and neuroeconomics, this paper demonstrates how the framework offers actionable strategies for mitigating cognitive biases, navigating market sentiment, and informing public policy. The discussion underscores CEF's potential to enhance economic models and decision-making, while also emphasizing the critical need for rigorous empirical validation to solidify its academic standing.

Three Centers, Ten Processes, One Economy: CEF as a Somatic Strategy for Economic Inquiry

1. Introduction: The Emotional Underpinnings of Economic Behavior

1.1. Traditional Economic Rationality vs. Behavioral Insights

For a considerable period, conventional economic theory has been built upon the premise of the "rational agent," an idealized individual who makes choices based purely on logical utility maximization1. This foundational assumption posits that individuals consistently weigh options, analyze facts, and compare numbers to arrive at optimal, logical decisions3. However, empirical data and real-world observations frequently challenge this presumption, revealing that actual economic behavior often deviates significantly from these rational predictions1.

The persistent deviation of real-world economic decisions from the predictions of traditional rational agent models underscores a fundamental limitation in their explanatory power4. This indicates that any economic framework that overlooks the profound influence of emotional and cognitive factors will inherently remain incomplete in its ability to predict and understand human behavior. Consequently, the integration of models such as the Core Emotion Framework becomes essential for developing a more descriptively robust understanding of economic phenomena2.

To address these discrepancies, the interdisciplinary field of behavioral economics emerged, integrating insights from psychology, neuroscience, and microeconomic theory into economic models4. Behavioral economics recognizes that emotions, cognitive biases, and social influences play a significant and often irrational role in shaping economic choices, challenging the traditional notion of the entirely rational agent3.

Further advancing this understanding, neuroeconomics utilizes neuroscientific tools to study the brain mechanisms underlying decision-making, confirming the fundamental role of emotions. This field reveals the coexistence of dual processes: System 1, which is fast, automatic, and emotional, and System 2, which is slow, deliberate, and analytical. These systems interact, often in complex ways, to drive economic choices1.

1.2. Overview of the Core Emotion Framework (CEF)

The Core Emotion Framework (CEF), developed by OptiCAPA.com (https://www.optimizeyourcapabilities.com), is presented as an innovative model for understanding and leveraging core emotional responses to enhance human capabilities11. Its central tenet is that emotions are not merely problems to be solved or simple reactions, but rather fundamental drivers and powers to be harnessed, serving as the psyche's essential engine12. By gaining a deeper understanding of this fundamental emotional architecture, individuals can strategically optimize their inner resources and achieve aspirations more efficiently11.

CEF organizes foundational emotional drivers into a systematic, hierarchical model across three primary centers: the Head, Heart, and Gut11. These centers house distinct yet intricately interconnected core emotions that influence perception, connection with others, and capacity for action11.

A crucial principle within CEF is its differentiation between core emotions and composite states. Emotions commonly referred to, such as fear and anger, are defined as composite states within CEF. They are not regarded as primary or core drivers but rather as nuanced, layered outcomes derived from the interplay and aggregation of the underlying core emotions organized across the Head, Heart, and Gut12. This explicit differentiation reinforces that the core emotions act as the fundamental building blocks from which all other, more intricate emotional states originate12.

While behavioral economics often identifies broad emotional influences like fear or greed as drivers of economic behavior1, CEF offers a deeper, more granular approach by defining ten specific core emotional processes and categorizing them under the Head, Heart, and Gut centers11. This detailed breakdown is not merely descriptive; it is prescriptive. For instance, instead of broadly stating that "fear causes market crashes," CEF suggests that fear is a composite of underlying core emotions, potentially involving "Sensing" (visualizing failure), "Constricting" (fixation on specific patterns), and "Accepting" (manifesting as passive surrender)12.

By identifying these constituent processes, CEF provides specific "Restructure Protocols" or "Amplify Protocols"12, such as challenging with "Calculating" or activating "Boosting." This offers a more precise and actionable pathway for individuals or policymakers to intervene and manage emotional impacts on economic decisions, moving beyond mere identification to targeted emotional regulation and utilization.

The framework also introduces the Emotion Utilization Model (EUM) and Adaptive Emotional Cycling. EUM transforms raw emotional responses into actionable strategies, affirming that emotions are powerful resources that can be intentionally leveraged to drive positive outcomes11. Adaptive Emotional Cycling involves intentionally navigating different emotional states to achieve specific goals, recognizing that various emotions can be strategically employed depending on the situation and desired outcome11.

1.3. Purpose and Scope of the Article

This article aims to explore how the Core Emotion Framework can provide a novel lens for understanding and resolving economic questions. It integrates CEF's core principles and proposed mechanisms with established academic research in behavioral economics and neuroeconomics. The discussion will demonstrate how CEF offers a structured, granular approach to analyze and potentially influence economic behaviors driven by emotion, thereby contributing to a more comprehensive and actionable understanding of economic decision-making.

2. The Core Emotion Framework (CEF): Structure and Mechanisms

2.1. Tripartite Emotional Architecture: Head, Heart, and Gut

The Core Emotion Framework posits that human emotional architecture is elegantly organized into three primary, yet interconnected, centers: the Head, Heart, and Gut11. This tripartite division aligns with broader psychological and neuroeconomic understandings of emotion, which often delineate cognitive, affective, and behavioral components, or distinguish between fast, intuitive (System 1) and slow, deliberative (System 2) processes1.

CEF's Head-Heart-Gut analogy provides a structured, intuitive, and holistic mapping of these components, serving as a comprehensive diagnostic tool for emotional responses and a strategic roadmap for self-awareness and efficiency12. This suggests that economic behaviors are not driven by a single emotional facet but by a complex interplay across these three integrated centers, providing a richer analytical framework.Each center encompasses specific sub-categories of emotions, offering a granular understanding of the emotional landscape11.

- Head: The Center of Cognition and Decision-Making

This domain represents cognitive and analytical functions11. It includes "Sensing," the initial stage of perception where individuals gather information and preliminarily register data; "Calculating," which involves in-depth analysis, logical processing, and critical thinking; and "Deciding," focused on making choices, weighing options, and setting priorities aligned with values and goals11. This aligns with the cognitive appraisal component in general emotion models11.

- Heart: The Realm of Emotional Flow

This center captures the affective and relational dynamics of human experience11. It encompasses "Expanding," describing emotions associated with openness, connection, and empathy; "Constricting," focusing on inward-directed feelings like introspection and setting boundaries; and "Achieving," which involves navigating social interactions, managing relationships, and adapting to social dynamics11. These elements relate to subjective emotional experience and relational aspects of emotion11.

- Gut: The Seat of Action and Motivation

At the foundational level, the Gut embodies instinctual, embodied, and action-oriented responses11. It comprises "Arranging," linked to organization and initiating action; "Appreciating," focusing on satisfaction and gratitude; "Boosting," encompassing energizing emotions that drive individuals towards objectives; and "Accepting," describing emotions associated with letting go and recognizing the need for rest and recovery11. This domain corresponds to physiological responses and behavioral tendencies11.

2.2. The Ten Core Emotional Processes

CEF meticulously identifies ten fundamental emotional processes, distinguishing itself by a granular and essential understanding of human emotional architecture12. These processes are: "Sensing," "Calculating," and "Deciding" within the Head center; "Expanding," "Constricting," and "Achieving" within the Heart center; and "Arranging," "Appreciating," "Boosting," and "Accepting" within the Gut center11.

Each of these core processes has a defined function, a proposed scientific basis, and a stated benefit12. For example, "Calculating" involves the prefrontal cortex, crucial for evaluating consequences and making deliberate choices12. "Deciding" is linked to dopamine pathways, vital for motivation and reinforcing goal-directed behavior12. "Sensing" is tied to the insula cortex, responsible for interoceptive attention, which is fundamental to emotional awareness12. "Appreciating" triggers the release of neurochemicals like serotonin and dopamine, associated with improved mood and overall well-being12.

The explicit linkage of CEF's ten core emotional processes to specific brain regions and neurochemicals is crucial. This grounds CEF in neuroeconomic principles, moving it beyond a purely conceptual model into the realm of empirically verifiable mechanisms2. By connecting to established neuroscience, CEF gains academic credibility and offers concrete biological targets for understanding and potentially influencing economic behavior. For example, if a lack of "Deciding" contributes to decision paralysis during economic crises8, understanding its dopamine link12 provides a neurobiological perspective on intervention strategies.

2.3. Emotion Utilization Model and Adaptive Emotional Cycling

The Core Emotion Framework incorporates the Emotion Utilization Model (EUM), which transforms raw emotional responses into actionable strategies. EUM posits that emotions are powerful resources that can be intentionally leveraged to drive positive outcomes, shifting the perspective from emotions as problems to be managed to powers to be harnessed11. This approach challenges the traditional view of emotions as mere reactions12.

A key technique within CEF is Adaptive Emotional Cycling, which involves intentionally navigating different emotional states to achieve specific goals. This recognizes that different emotions can be strategically leveraged depending on the situation and desired outcome11.

CEF provides "formulas" for common emotional experiences, such as anxiety, anger, and joy, and for states like success12. Alongside these formulas, it offers "Restructure Protocols" or "Amplify Protocols" to consciously manage or enhance these emotional experiences by engaging different core functions12. For instance, the "Resilience Cocktail" combines "Sensing" (detecting early stress), "Accepting" (acknowledging the current situation), and "Boosting" (activating personal agency) to support rapid recovery from setbacks12. Similarly, the "Decision Excellence Stack" involves "Expanding" (brainstorming options), "Calculating" (scoring alternatives), and "Deciding" (setting a deadline for choice) to foster confident decision-making12.

While behavioral economics identifies biases and emotional influences, and neuroeconomics explains the underlying brain mechanisms2, CEF explicitly offers prescriptive "protocols" and "formulas" for emotional regulation and utilization12. This represents a significant advancement beyond purely descriptive analysis. For example, the "Decision Excellence Stack" directly addresses the challenge of suboptimal economic decision-making by prescribing a sequence of emotional processes (Expanding for ideation, Calculating for evaluation, Deciding for action)12. This provides a potential framework for designing targeted interventions, training programs, or "nudges"6 to improve economic outcomes at both individual and institutional levels.

3. CEF and Economic Decision-Making: Theoretical Overlaps

The Core Emotion Framework offers a valuable lens through which to examine and integrate with established theories in behavioral economics and neuroeconomics, particularly concerning cognitive biases, social dynamics, and risk perception.

3.1. Cognitive Biases and the "Head" Emotions (Sensing, Calculating, Deciding)

Traditional economic models, assuming rational choices, often fail to account for the systematic deviations observed in human decision-making, which behavioral economics attributes to cognitive biases4.

One prominent example is Prospect Theory, formulated by Daniel Kahneman and Amos Tversky, which demonstrates that individuals value losses more heavily than equivalent gains, a phenomenon known as loss aversion4. This bias can lead to overly cautious investment strategies, where the pain of losing is psychologically about twice as powerful as the pleasure of gaining8. Neuroeconomic studies further support this by showing that loss aversion correlates with activation in brain regions such as the ventral striatum and ventromedial prefrontal cortex9.

Another pervasive bias is the Framing Effect, where decisions are significantly influenced by how options are presented4.

Neuroeconomics indicates that amygdala activity correlates with choices favored by a particular frame, suggesting an emotional underpinning to this bias9.

Cognitive biases like loss aversion and framing effects4 frequently lead to irrational economic decisions. While behavioral economics effectively identifies these biases, CEF, through its "Head" emotions, offers a process-oriented approach to mitigate them. "Sensing," the initial stage of perception11, is crucial for how information is received, which can be manipulated by framing4. Training in "Sensing" could enhance an individual's awareness of how information is presented, potentially reducing susceptibility to framing effects.

"Calculating," which involves logical processing and critical thinking11, directly counters biases by promoting in-depth analysis of risks and rewards12. Strengthening "Calculating" could help individuals move beyond the immediate emotional impact of potential losses to a more objective assessment, thereby mitigating loss aversion. This intentional engagement of "Calculating" can help override the intuitive, System 1 responses1 that frequently lead to biased decisions.

Furthermore, "Deciding," the process of making choices and setting priorities11, is linked to dopamine pathways for motivation12 and can help overcome "decision paralysis" observed during periods of economic uncertainty8. The "Decision Excellence Stack" (Expanding → Calculating → Deciding)12 is a direct CEF application designed to foster confident decision-making. This suggests CEF provides a practical, internal mechanism for individuals to enhance their bounded rationality4.

3.2. Social Dynamics, Market Sentiment, and "Heart" Emotions (Expanding, Constricting, Achieving)

Economic decisions are not made in isolation but are significantly influenced by collective mood and social factors1. Investor sentiment, driven by periods of high optimism or widespread fear, can lead to phenomena such as market bubbles or crashes1.

A key aspect of this influence is Behavioral Contagion and Herd Behavior, where emotional states spread rapidly through a population, leading investors to follow the actions of others rather than relying on independent assessments1. This can result in significant market shifts. The 2008 financial crisis serves as a stark example, where a pervasive sense of fear and loss of trust in financial institutions accelerated market declines through emotional contagion1. Additionally, Intertemporal Choice, which involves decisions balancing immediate benefits against future outcomes, is profoundly influenced by emotions10. For instance, fear can make all but the least risky outcomes appear threatening, while positive emotions like happiness and gratitude can increase patience and encourage delayed gratification18.

Market sentiment, herd behavior, and emotional contagion1 are powerful drivers of economic anomalies like bubbles and crashes. While these phenomena are well-documented, CEF's "Heart" emotions offer a framework for individual agency within these collective dynamics. "Expanding," which encompasses openness, connection, and empathy11, is critical for navigating group dynamics. By fostering balanced "Expanding," individuals can engage in collaborative efforts and build trust without succumbing to uncritical herd mentality. "Achieving," related to managing social interactions and adapting to social dynamics11, can enhance negotiation skills and client relations11, which are vital in market interactions.

Conversely, "Constricting," involving introspection and setting boundaries11, can help individuals maintain personal understanding and priorities amidst collective emotional pressures, acting as a buffer against negative contagion. The "calm response system" linked to "Constricting"12 can reduce stress12, often a precursor to irrational herd behavior. This suggests that a better understanding and utilization of "Heart" emotions could lead to more resilient and less volatile market behaviors, moving beyond simply observing contagion to actively mitigating its negative effects.

3.3. Motivation, Risk Perception, and "Gut" Emotions (Arranging, Appreciating, Boosting, Accepting)

Emotions significantly influence risk perception and economic behavior, with individuals often relying on immediate feelings rather than detailed analysis when assessing risk3. This is particularly evident in the Affect Heuristic, where people rely on their overall affective impression of a target to form judgments of risk and benefit, often inversely related20. Positive feelings tend to reduce perceived risk, while negative feelings increase it19.

The Somatic Marker Hypothesis (SMH), proposed by Antonio Damasio, posits that emotion-based biasing signals, or "somatic markers," originating from the body, are integrated in higher brain regions to regulate decision-making, especially under uncertainty22. These markers, often operating at a nonconscious level, guide choices by associating options with positive or negative feelings22. For example, a feeling of excitement or euphoria due to a sudden gain in the market can lead to continued, irrational risk-taking23.

The Somatic Marker Hypothesis22 and Affect Heuristic20 highlight that economic decisions are often guided by immediate, often non-conscious, emotional and physiological signals. CEF's "Gut" emotions provide a framework for understanding and managing these visceral responses.

"Sensing," which involves detecting internal and external stimuli11, is foundational to recognizing somatic markers and immediate affective responses. "Boosting," the confidence amplifier and motivator11, can directly influence risk propensity. By cultivating "Boosting," individuals might overcome fear-induced decision paralysis8 and engage in more appropriate risk-taking when rational.

Conversely, "Accepting," involving letting go and recognizing the need for rest11, reduces stress reactivity and rumination12. This can be crucial in managing the emotional aftermath of economic losses or uncertainty, preventing maladaptive behaviors such as repeated mistakes or excessive risk-taking23.

The "Resilience Cocktail" (Sensing → Accepting → Boosting)12 offers a direct application for managing stress and uncertainty.

"Arranging," linked to organization and initiating action11, helps create structure from chaos12, which can be vital in managing complex economic situations and reducing cognitive load12 that might otherwise lead to an over-reliance on heuristics. Finally, "Appreciating," fostering satisfaction and gratitude11, triggers mood-enhancing neurochemicals12 and can shift perspective, promoting wiser decision-making18 by reducing the influence of negative emotional biases. This suggests CEF offers practical tools to cultivate emotional intelligence at a primal, intuitive level, directly impacting how individuals perceive and respond to economic risks and opportunities.

4. Applications of CEF in Economic Contexts

The Core Emotion Framework offers valuable insights and actionable strategies for enhancing performance and fostering growth across various economic domains, from individual consumer choices to broad public policy.

4.1. Consumer Behavior and Purchasing Decisions

Consumer decisions are profoundly influenced by psychological factors, emotions, and cognitive biases, often leading to choices that deviate from purely rational economic models5. Retailers strategically leverage emotions through advertising to create strong associations between their brands and desirable feelings like happiness, security, or excitement, thereby influencing purchasing decisions even when product attributes are similar across competitors1.

Behavioral economics identifies tactics like scarcity marketing and social proof5. CEF's granular emotional processes provide a more precise framework for marketers. Instead of broadly targeting "fear," CEF can help identify if the fear stems from a lack of "Sensing" information, an inability to "Calculate" risks, or a struggle with "Accepting" uncertainty11. This allows for highly targeted marketing messages and product designs that address specific emotional "pain points" or amplify desired "pleasure points"3 at a deeper, more fundamental level, potentially leading to stronger brand loyalty and more predictable consumer responses.

This represents a shift from general emotional marketing to emotionally calibrated marketing. By mapping consumer emotional triggers to CEF's core processes, businesses can design products and marketing campaigns that align with specific "Head," "Heart," or "Gut" emotional states. For instance, scarcity marketing5 could tap into "Constricting" (setting limits/urgency)11, while brand loyalty can be strengthened by fostering "Expanding" (connection) 11 and "Appreciating" (satisfaction)11. CEF's "Emotion Mapping" tool11 could be adapted for consumer research to systematically identify emotional responses to products or services.

4.2. Investor Sentiment and Market Dynamics

Investor sentiment significantly influences market trends, price movements, trading volumes, and volatility, and can even contribute to market bubbles and crashes1. Fear and excitement are powerful emotional drivers of market behaviors that often puzzle analysts relying purely on rational market theories8. Behavioral finance specifically examines how psychological factors influence investor behavior15, with indices like the Volatility Index (VIX) serving as proxies for the general emotional state of the market.8

CEF offers a structured approach to emotional intelligence for investors. By understanding their own "Head," "Heart," and "Gut" emotional processes11, investors can identify when their decisions are swayed by biases, such as loss aversion10 or recency bias4, or by collective emotional contagion8. The "Restructure Protocols"12 can help individuals shift from panic-driven "Constricting" or "Accepting" (as passive surrender) to more constructive "Calculating" and "Boosting"12. This empowers individual investors to make more informed and resilient decisions, potentially dampening the impact of irrational exuberance or fear on overall market stability.

Investors can also utilize CEF to refine their risk management strategies8. By enhancing their "Head" emotions, they can improve "Calculating" risks and "Deciding" on investments, thereby reducing cognitive biases like overconfidence14 or recency bias4. Cultivating "Constricting" can assist in setting prudent boundaries on risk exposure, while "Accepting" can aid in managing losses without succumbing to panic-selling8. "Boosting" can provide the necessary confidence for contrarian investment strategies during periods of widespread pessimism1. CEF's Adaptive Emotional Cycling could be applied to intentionally shift emotional states to better suit prevailing market conditions, for example, by emphasizing "Constricting" during periods of high volatility and "Boosting" during perceived opportunities.

4.3. Public Policy and Economic Interventions

Policymakers are often influenced by public sentiment8 and have the capacity to design initiatives that promote confidence and stability at a societal level1. Behavioral economics provides valuable insights for designing interventions, often referred to as "nudging," that encourage better decision-making among the populace6.

Public policy often aims to influence economic behavior, but traditional approaches may overlook the emotional drivers8. Behavioral economics introduces "nudging" as a means to subtly influence choices6. CEF provides a more nuanced understanding of the specific emotional mechanisms that can be targeted. For example, if public panic accelerates austerity measures during an economic downturn8, CEF suggests that this panic might involve a combination of "Sensing" threats, "Constricting" resources, and a lack of "Accepting" the situation11. Policymakers could then design interventions that specifically aim to activate "Calculating" (to rationally assess options), "Boosting" (to instill confidence), and "Expanding" (to foster collective action)11. This allows for a more emotionally intelligent and potentially more effective design of public policies that promote desired economic outcomes and stability.

CEF can inform public policy by helping policymakers understand the underlying emotional processes driving public responses to economic measures. For instance, during economic downturns, transparent communication1 can mitigate panic by addressing the public's "Sensing" of uncertainty and fostering "Accepting" of the situation, while simultaneously "Boosting" confidence in recovery plans. Policies aimed at encouraging long-term planning8 could leverage "Calculating" to highlight future benefits and "Appreciating" to reinforce positive outcomes of delayed gratification18. The "Resilience Cocktail" (Sensing → Accepting → Boosting)12 could be adapted as a public communication strategy during crises to foster collective resilience.

5. Implications, Limitations, and Future Research

5.1. Enhancing Economic Models and Predictions

The Core Emotion Framework's granular emotional processes have the potential to significantly enrich existing dual-process models prevalent in behavioral economics, such as the System 1 (fast, intuitive) and System 2 (slow, reflective) framework1. Dual-process theories are widely used to explain bounded rationality in decision-making27. While these models acknowledge emotional influence, CEF provides a sub-structure for System 1. Instead of a monolithic "E" representing emotional influence in mathematical models (D = α ⋅ R + (1−α) ⋅ E) 1, CEF breaks it down into distinct Head, Heart, and Gut processes, each with its own sub-components11. This allows for a more precise understanding of which specific emotional processes contribute to a decision, enabling more sophisticated mathematical modeling (e.g., by assigning weights or interactions to individual CEF components) and potentially leading to more accurate predictions of economic behavior. It transforms a black-box "emotional" input into a transparent, structured emotional architecture.

CEF offers a framework for integrating the "affective" (emotional) and "analytic" (rational) components of decision-making1, moving beyond a simple alpha weighting to a more dynamic, process-based understanding. This detailed approach can lead to more nuanced economic predictions and a deeper comprehension of how emotional states translate into observable economic actions.

5.2. Practical Strategies for Individuals and Institutions

The Core Emotion Framework offers actionable strategies that extend beyond theoretical understanding, providing tangible benefits for individuals and institutions operating within economic systems.

For individuals, applying CEF principles can lead to improved financial decision-making, better personal risk management, and enhanced resilience to economic shocks. By understanding and managing their core emotional processes, individuals can make more deliberate and less impulsive choices in areas such as saving, investing, and consumption.

For businesses, CEF provides a framework for developing tailored marketing strategies that resonate more deeply with consumers, fostering stronger brand loyalty, and designing financial products that align with the emotional profiles of different demographics1. This allows companies to move beyond superficial emotional appeals to address fundamental emotional drivers.

For policymakers, CEF can inform the design of initiatives that effectively promote confidence and stability within the economy, and critically, mitigate panic during crises1. By understanding the specific emotional states of the public, policies and communications can be crafted to address underlying anxieties and foster collective positive action.

5.3. Methodological Considerations and Future Research

The Core Emotion Framework is presented on free-for-use and non-commercial websites, but while it draws on existing psychological and neuroscientific research to explain its proposed mechanisms11, the framework itself lacks direct, peer-reviewed empirical studies demonstrating its specific efficacy in economic contexts. For CEF to gain full academic acceptance and be truly integrated into economic science, it must undergo rigorous empirical validation. This would involve designing controlled experiments, similar to those routinely conducted in behavioral economics6, to test CEF's "Restructure Protocols" or "Amplify Protocols"12 on economic behaviors such as investment decisions, consumer choices, or responses to economic stimuli.

Neuroimaging studies2 could further investigate whether the proposed neural mechanisms of CEF's core emotions12 are indeed activated and influence economic outcomes as hypothesized. Without this direct empirical evidence, CEF remains a promising conceptual model, but its academic utility in resolving economic questions is limited by a lack of direct empirical support.

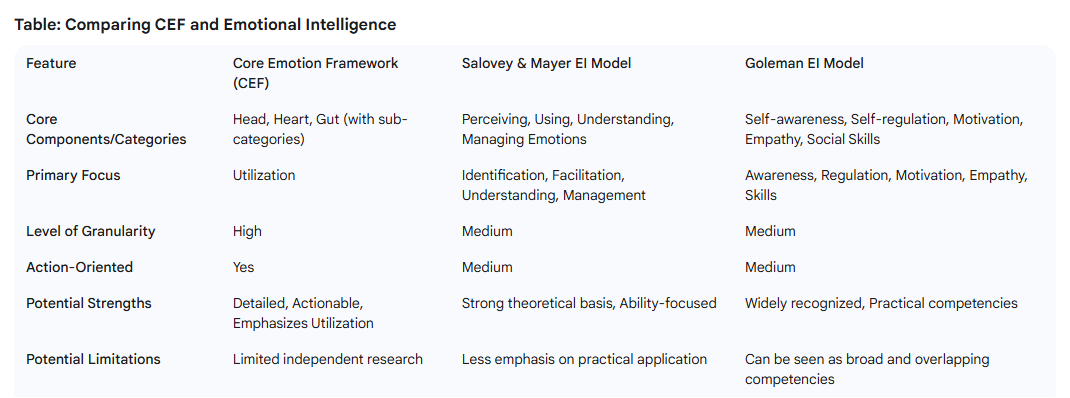

Future research should also include a comparative analysis of CEF's efficacy and explanatory power against other established frameworks in behavioral economics and neuroeconomics, such as Prospect Theory, the Somatic Marker Hypothesis, and Dual Process Theory. This would help identify CEF's unique contributions and limitations relative to existing models.

Longitudinal studies are also crucial to investigate the long-term effects of applying CEF principles on economic outcomes, financial well-being, and resilience to market fluctuations.

Works cited

- See How Emotions Shape Our Choices in Economics - Number Analytics, accessed July 22, 2025, https://www.numberanalytics.com/blog/emotional-decisions-behavioral-economics

- (PDF) Exploring the Functional Framework of Neuroeconomics: Integrating Emotions and Decision-Making in Behavioral Economics - ResearchGate, accessed July 22, 2025, https://www.researchgate.net/publication/388923726_Exploring_the_Functional_Framework_of_Neuroeconomics_Integrating_Emotions_and_Decision-Making_in_Behavioral_Economics

- Emotional Economics: How Feelings Influence Purchase Decisions - Braintrust Growth, accessed July 22, 2025, https://braintrustgrowth.com/emotional-economics-how-feelings-influence-purchase-decisions/

- Behavioral economics - Wikipedia, accessed July 22, 2025, https://en.wikipedia.org/wiki/Behavioral_economics

- Behavioral Economics: Psychological Factors Influencing Economic Decisions, accessed July 22, 2025, https://www.renascence.io/journal/behavioral-economics-psychological-factors-influencing-economic-decisions

-

Behavioural Economics and Decision Making - IJFMR, accessed July 22, 2025, https://www.ijfmr.com/papers/2024/2/16317.pdf

- Behavioral Economics and Decision-Making: The Impact of Psychological Insights on Economic Choices - Allied Business Academies, accessed July 22, 2025, https://www.abacademies.org/articles/behavioral-economics-and-decisionmaking-the-impact-of-psychological-insights-on-economic-choices-17218.html

- Discover the True Impact of Emotions on Economy - Number Analytics, accessed July 22, 2025, https://www.numberanalytics.com/blog/impact-emotions-economic-decisions

- Neuroeconomics, decision-making and rationality, accessed July 22, 2025, https://journals.openedition.org/ei/74?lang=en

- Prospect Theory: What It Is and How It Works, With Examples, accessed July 22, 2025, https://www.investopedia.com/terms/p/prospecttheory.asp

- The Core Emotion Framework (CEF) for Optimizing Capabilities, accessed July 22, 2025, https://optimizeyourcapabilities.pro

- Core Emotion Framework (CEF), accessed July 22, 2025, https://coreemotionframework.com

- Prospect Theory - The Decision Lab, accessed July 22, 2025, https://thedecisionlab.com/reference-guide/economics/prospect-theory

- Risk Perception, Econ & Bias: A Smart Guide - Number Analytics, accessed July 22, 2025, https://www.numberanalytics.com/blog/risk-perception-econ-bias-guide

- The Influence of Investor Sentiment on the Stock Market - Equirus Wealth, accessed July 22, 2025, https://www.equiruswealth.com/blog/the-influence-of-investor-sentiment-on-the-stock-market

- The correlations between emotional effects on inter-temporal choice and... - ResearchGate, accessed July 22, 2025, https://www.researchgate.net/figure/The-correlations-between-emotional-effects-on-inter-temporal-choice-and-time-perception_fig5_275895151

- The Effect of Future Event Markers on Intertemporal Choice Is Moderated by the Reliance on Emotions versus Reason to Make Decisions - Oxford Academic, accessed July 22, 2025, https://academic.oup.com/jcr/article-pdf/44/2/313/25723494/ucw081.pdf

- How Emotions Influence Economic Decisions - YouTube, accessed July 22, 2025, https://www.youtube.com/watch?v=pZphBOAkH8E

- Emotions and Risk Perception - ResearchGate, accessed July 22, 2025, https://www.researchgate.net/publication/228541132_Emotions_and_Risk_Perception

-

www.numberanalytics.com, accessed July 22, 2025, https://www.numberanalytics.com/blog/quick-look-affect-heuristic-economic-choices#:~:text=The%20affect%20heuristic%20was%20formally,immediate%20feelings%20about%20an%20option.

- The affect heuristic in early judgments of product innovations ..., accessed July 22, 2025, https://www.researchgate.net/publication/265645992_The_affect_heuristic_in_early_judgments_of_product_innovations

- Critical Review of the Somatic Marker Hypothesis - MRC Cognition ..., accessed July 22, 2025, https://www.mrc-cbu.cam.ac.uk/personal/tim.dalgleish/dunnsmhreview.pdf

- Somatic Marker Hypothesis and Economic Decision Making - Investopedia, accessed July 22, 2025, https://www.investopedia.com/somatic-marker-hypothesis-7488254

- Definition and Examples of the Consumer Decision-Making Process | Lucidchart Blog, accessed July 22, 2025, https://www.lucidchart.com/blog/consumer-decision-making-process

- What Is Consumer Psychology? | USC MAPP Online, accessed July 22, 2025, https://appliedpsychologydegree.usc.edu/blog/what-is-consumer-psychology

- D-Street ahead: What will guide market sentiment this week? Here's all you need to know, accessed July 22, 2025, https://timesofindia.indiatimes.com/business/india-business/d-street-ahead-what-will-guide-market-sentiment-this-week-heres-all-you-need-to-know/articleshow/122793857.cms

-

Dual Process Theory: Embodied and Predictive; Symbolic and Classical - Frontiers, accessed July 22, 2025, https://www.frontiersin.org/journals/psychology/articles/10.3389/fpsyg.2022.805386/full

-

Dual Process Theory: Embodied and Predictive; Symbolic and Classical - PubMed Central, accessed July 22, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8979207

-

Optimizeyourcapabilities.com. (2025). The Core Emotion Framework (CEF): A Theoretical Synthesis Integrating Affective Neuroscience, Embodied Cognition, and Strategic Emotional Regulation for Optimized Functioning [Zenodo]. https://doi.org/10.5281/zenodo.17477547

-

Optimizeyourcapabilities.com. (2025, November 14). A Proposal for Open Validation of the Core Emotion Framework (CEF): A Structural-Constructivist Model for Emotional Regulation and Psychological Flourishing. https://doi.org/10.17605/OSF.IO/SG3KM

- Bulgaria, J. (2025). Compendium of Evidence-Based Psychotherapy Modalities: Reframed through the Core Emotion Framework (CEF). Zenodo. https://doi.org/10.5281/zenodo.17665533

- Bulgaria, J. (2025, November 21). Pre-Registration Protocol: Open Validation of the Core Emotion Framework (CEF) Scale – Phase 1: Construct Definition, Item Generation, and Multi-Level Factor Structure Confirmation. https://doi.org/10.17605/OSF.IO/4RXUV

- Bulgaria, J. (2025). The Core Emotion Framework (CEF): A Structural-Constructivist Model for Emotional Regulation and Adaptive Resilience in the Treatment of Anxiety. Zenodo. https://doi.org/10.5281/zenodo.17693163

- Bulgaria, J. (2025). Extending the Core Emotion Framework: A Structural-Constructivist Model for Obsessive- Compulsive Disorder (OCD). Zenodo. https://doi.org/10.5281/zenodo.17713676

- Bulgaria, J. (2025). Structural Psychopathology of Major Depressive Disorder_ An Expert Validation of the Core Emotion Framework (CEF). Zenodo. https://doi.org/10.5281/zenodo.17713725